Form 1095-C is a tax form required by the Affordable Care Act. The ACA requires large employers, such as Vanderbilt, with 50 or more full-time employees to offer health insurance to their workers. Form 1095-C allows the Internal Revenue Service to confirm Vanderbilt’s compliance with the coverage and affordability provisions of the ACA and assists Vanderbilt employees in preparing to file their 2022 tax returns.

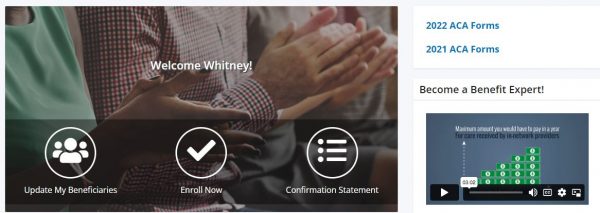

Every employee of Vanderbilt University who is eligible for insurance coverage should receive a 1095-C. The form will be available by March 3 for download from My VU Benefits. The form is on the home screen once you log in to your account (see picture for reference). Vanderbilt also will mail a copy to the employee address on file in Oracle.

Eligible employees who declined to participate in the health plan will still receive a 1095-C.

The form identifies:

- the employee and the employer

- which months during the year the employee was eligible for coverage

- the cost of the cheapest monthly premium the employee could have paid under the plan

How do I use the information on my Form 1095–C?

This form provides you with information about the health coverage offered by Vanderbilt.

If you enrolled in a health plan through the marketplace, the information in Part II of Form 1095–C could help determine if you’re eligible for the premium tax credit.

If there is information in Part III of Form 1095–C, review this information to determine if there are months when you or your family members did not have coverage. If there are months you did not have coverage, you should determine if you qualify for an exemption from the requirement to have coverage.

Do not attach Form 1095–C to your tax return; keep it with your tax records.