Effective Jan. 1, 2024, Vanderbilt will match up to 6 percent of your retirement plan contributions. This includes a 3 percent match of your mandatory contribution and up to 3 percent match of your voluntary contribution.

Additionally, newly hired full-time regular faculty and staff, and part-time regular staff are automatically enrolled in the plan with contributions of 6 percent of your pre-tax salary. Three percent of this is a mandatory pre-tax contribution and is a condition of employment, and 3 percent is voluntary. This total of 6 percent in contribution is matched 100 percent, dollar-for-dollar, by Vanderbilt.

You may elect to reduce or opt out of the 3 percent voluntary contribution, but you would not receive the entire available matching contribution from Vanderbilt. Voluntary contributions can either be pre-tax on Roth (after-tax) and Vanderbilt will match either or a combination of the two up to 3 percent.

How the match works

Here are some examples to demonstrate how the match works.

Example 1:

If you elect 5 percent voluntary contributions, your total employee contribution will be 8 percent (3 percent mandatory + 5 percent voluntary = 8 percent total employee contribution). Vanderbilt will match a total of 6 percent of these contributions.

Example 2:

If you elect 2 percent voluntary, your total employee contribution will be 5 percent (3 percent mandatory + 2 percent voluntary = 5 percent total employee contribution). Vanderbilt will match a total of 5 percent of these contributions. Note that this election does not maximize Vanderbilt’s voluntary matching contribution.

How to make voluntary contribution changes

- Option 1 – call Fidelity’s Retirement Service Center at 800-343-0860 and request to have your voluntary contributions in the Vanderbilt Retirement Plan changed

- Option 2 – complete through Fidelity Netbenefits®

- Option 3 – complete through Fidelity mobile app

How to make changes in NetBenefits:

- Visit netbenefits.com and log in, or register if you haven’t already done so

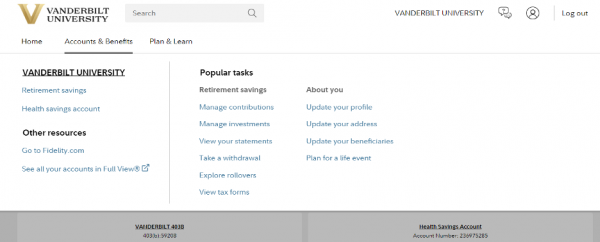

- Once logged in from the home page select “Accounts & Benefits” and choose “Manage contributions”

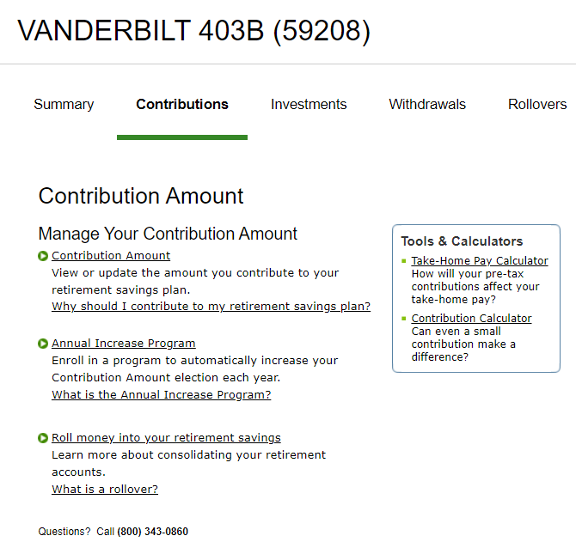

- On the following page select the “Contribution Amount” option under “Manage Your Contribution Amount”

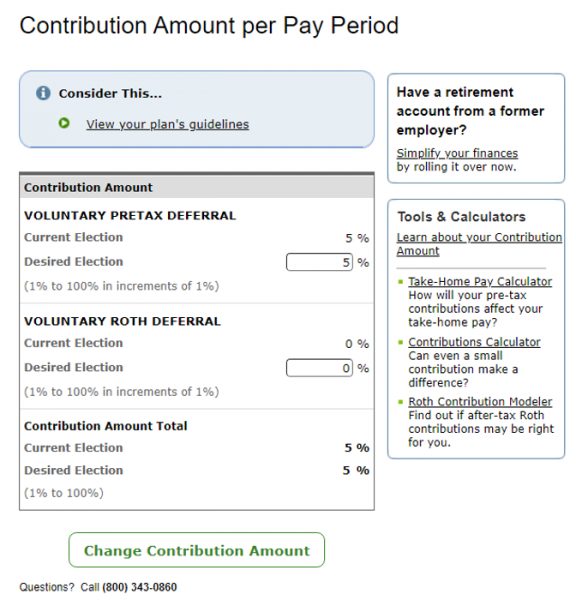

- On the following page update the contribution percentage in either the pre-tax or Roth deferral field and click “Change Contribution Amount”

Note: Only your voluntary elections are displayed on the NetBenefits site. The deferral election you choose above is in addition to your mandatory 3 percent contribution (for eligible employees).