Due to COVID-19, the IRS is allowing employees who face changes in their dependent care situation to qualify as a “change in status.” Therefore, employees may increase, decrease or stop funds from being deposited into a Dependent Care Flexible Spending Account (DCFSA). This guidance allows an election change for:

- reductions in work hours

- change in employment status

- FMLA leave

- substantial change in employer benefits/cost

- change of cost from the provider

- change of provider resulting in change of cost

- provider no longer providing care (i.e. summer camp is canceled)

These changes are prospective, which means that a change can be made now and remain in place for the rest of 2020. Changes cannot be retrograded to Jan. 1, 2020.

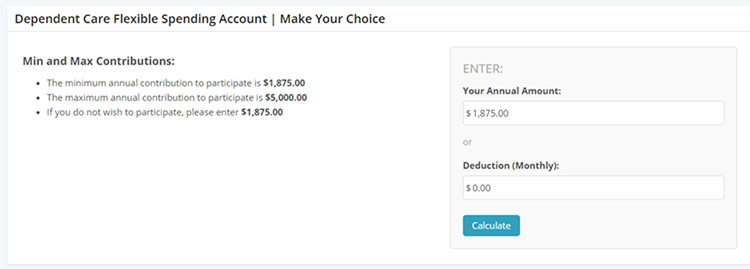

Example: Employee elected $4,500 at Open Enrollment, which is $375 per month (and at today’s date – this person has five deductions taken – totaling $1,875).

The employee completes a DCFSA event and would like to drop the DCFSA deductions – the system will account for the deductions that have already been taken.

To make a change to your DCFSA election, go to the My VU Benefits website.

- Log in with your VUnetID and ePassword.

- On the left-hand side of the page, select “Life Events.”

- Select “Dependent Care FSA Changes.”

- Enter today’s date and from here, the system will walk you through the simple process of changing your benefits.

- Confirm your election. The last page/section in the enrollment is your confirmation statement, which you should print or email to yourself for your records.

- This completes the Family Status Change process. You will be contacted via email if additional information or documentation is needed.

Please note this does not change the claims deadline for DCFSAs. The money contributed to your FSA account must be used during the calendar year; it does not carry over from year to year. You do have a grace period in which you are allowed additional time to incur claims for reimbursement. This grace period allows participants to incur claims until March 15 of the following plan year. Money not used will be forfeited.

For more information, contact Human Resources at human.resources@vanderbilt.edu or 615-343-4788.